Mexican Power System

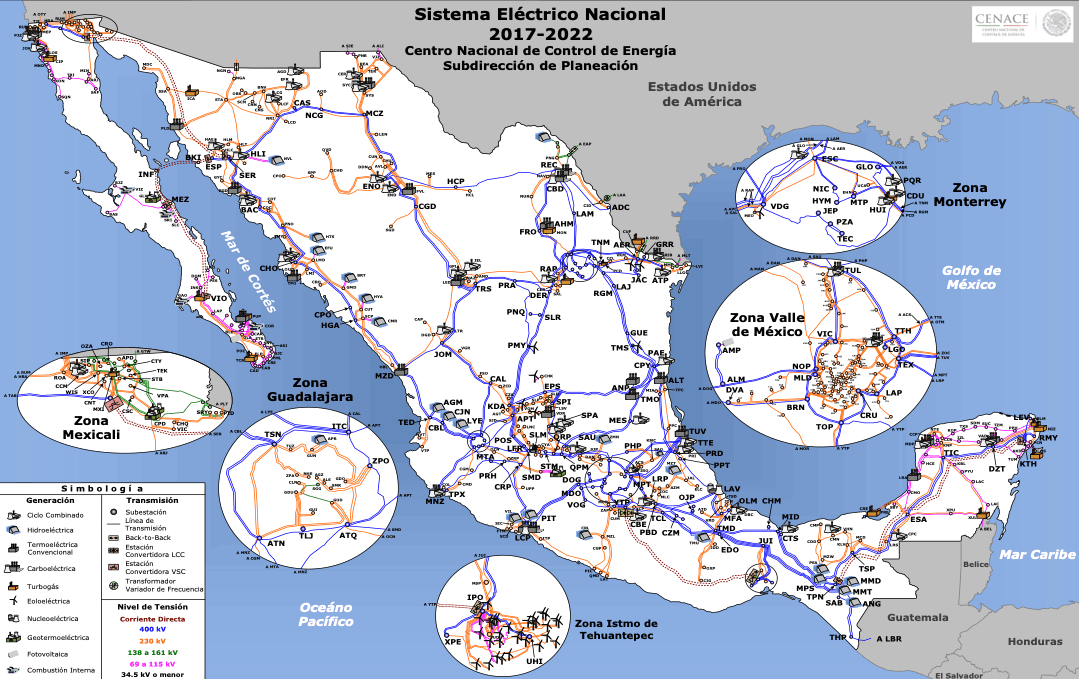

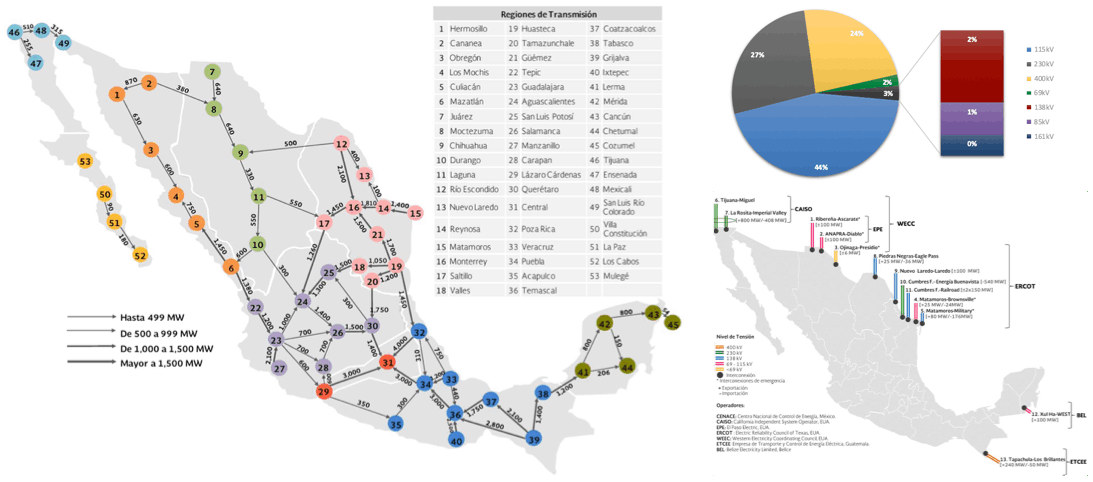

The Mexican Power System is formed by four independent power systems: SIN (National Interconnected System) that covers most of Mexican Territory, except the Baja California Peninsula; and three systems in the Baja Area: Baja, Baja Sur and Mulegé, these two last are isolated systems.